The adage “it starts at the top” could apply to any dynamic—a sports team, classroom, or Fortune 500 company—where leadership is central to a group’s success. But in business, can the value and performance of top-level managers and corporate boards be quantified?

Illinois Tech’s new Center for Corporate Performance (CCP) will undertake a “big data” approach to find out.

Located within Stuart School of Business, the CCP will create a large-scale, integrated database that will include organizational, financial, and economic variables for a large sample of public firms in the S&P 1500 Index. Using this information, CCP researchers will study the relationships between corporate governance and organizational practices and the long-term economic and financial performance of a firm.

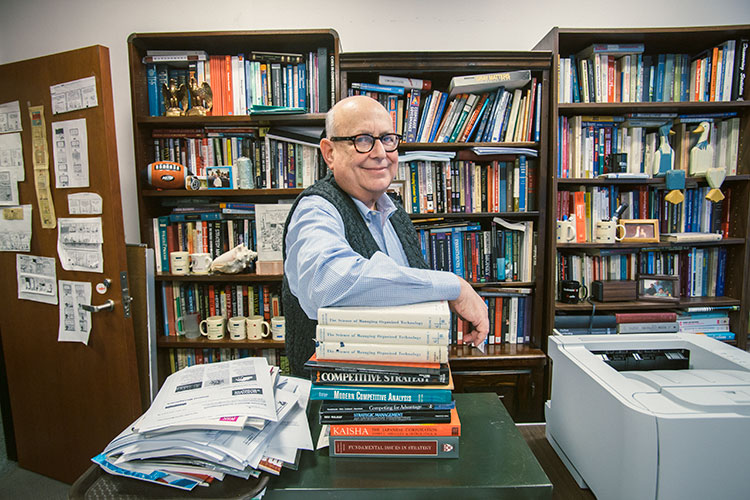

The CCP is chaired by retired attorney and Harvard M.B.A. Mitchell Saranow and managed by Joel Goldhar, former dean (1983–88) and professor of operations and technology management.

“The hot topics of director tenure and the ‘missing COO’ phenomenon occurring as companies ‘flatten’ their traditional hierarchies illustrate the type of research we plan to perform in the CCP,” says Goldhar.

Carl Stern, chairman at Carl W. Stern Associates and former vice chairman of the Investment Banking Division at Goldman Sachs, serves as a CCP participating executive. As an advisor to chief executive officers, he envisions how companies can benefit from access to CCP data.

“One of my clients, a Fortune 50 CEO, wrestles with his board over whether or not a COO makes sense for the organization,” Stern explains. “Everyone has an opinion, but not the data they need to back them up.” He adds that CCP data also would be valuable in discovering the direct correlation between executive compensation and performance. “Rigorous testing through the CCP could help determine the way in which to reward people,” says Stern. “We could call on a data set to prove it.”

Currently, management decisions, policymaking, and even academic research rely on primarily anecdotal evidence and simplistic statistical analyses. Goldhar explains that research conducted at the CCP will move beyond the anecdotal and focus on the comprehensive information collected in its one-of-a-kind database.

The CCP will aid firms as they make decisions about the allocation of roles and resources and the setting of compensation levels, for example. Not only will the CCP enhance corporate decision making, but it also will prove to be an invaluable resource for academic research.

“We are trying to build a bridge between finance and economics, management and organizational structure, and theory and practice,” Goldhar says.

Creating a database involves more than purchasing and combining information from sources like Bloomberg, ExecuComp, and BoardEx. The data from each of the 1,500 U.S. firms has to be “cleaned and coded” in order to standardize terminology for reporting organizational variables such as executive job titles. Aiding in this intensive process is Stuart Ph.D. student Joe Cursio, a former programmer on Wall Street who shares Goldhar’s vision of using big data. He will continue to merge data from different sources and define the measures needed.

Saranow, who provided the seed capital for the project, says the CCP will rigorously test organizational and corporate governance structures and empower companies “to concentrate efforts on implementing ideas that have a high probability of positive results.”

CCP Participating Executive Howard Smith, managing director at First Analysis in Chicago, says that while there is ample and increasing data to inform tactical and operational decisions in business, data regarding the influence of organizational structure is lacking. “With the CCP, we are hoping we can bring some real discipline to this area—real data,” Smith says.